Broker perspectives

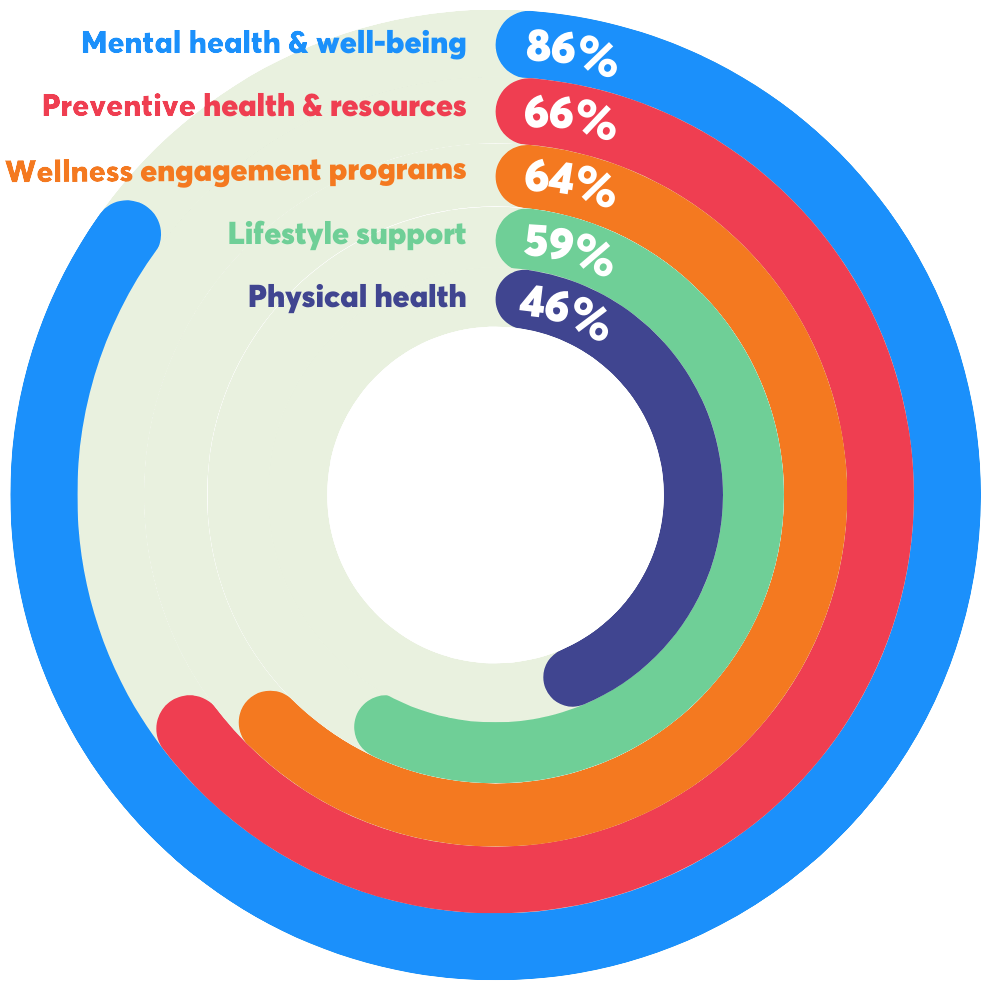

Our clients are investing in mental health and well-being benefits now more than they ever have. They’re realizing how important it is for employees to feel supported, so many are offering more robust mental health benefits.

More clients are investing in more meaningful mental health programs than ever before. There's still a LOT of ground to cover with addressing genuine psychological safety.

There’s a big push to make talking about mental health more normal, which helps break down any stigma. Clients are driving their carrier resources with mental health resource guides & one pagers.

Most clients now have an EAP to address these issues, but some clients are switching from traditional EAP’s to more robust offerings with more free therapy sessions. Plus, using apps and online resources is making it easier for everyone to get the help they need.

We've seen a huge wave of clients moving toward more robust

stand-alone mental health programs and moving away from EAPs tied to

life insurance and disability.

We've seen a huge wave of clients moving toward more robust

stand-alone mental health programs and moving away from EAPs tied to

life insurance and disability.