With recent evidence highlighting the considerable effect financial hardships have on employee wellness and workplace productivity, businesses are increasingly adopting workplace health initiatives to encompass financial wellness. For employees, financial wellness is defined as being in a place where they are spending and saving money thoughtfully, and their behaviors and thinking around personal finances contribute positively to short-term and long-term goals. Surveys show that employees are universally struggling to achieve this state on their own. In fact, 54% of employees reported being stressed about their finances, and roughly half of them admitted to being distracted, spending a decent amount of time handling personal finances at work. As a result, financial unwellness contributes to massive amounts of anxiety in the workplace and hinders productivity.

Before business leaders can provide effective financial wellness benefits to their employees, they must first assess and understand the needs of their teams.

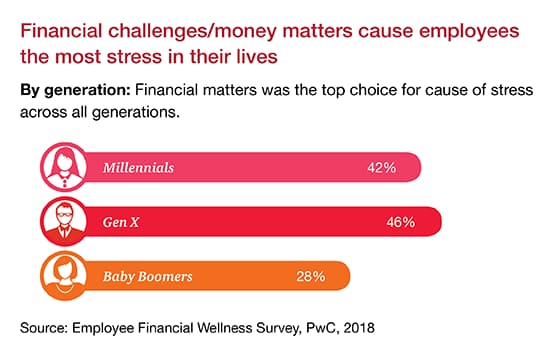

Although financial hardship has been voted the main contributor of stress across all generations (42% of millennials, 48% of Gen Xers, and 28% of Baby Boomers chose financial matters as their top choice for cause of stress), each of these groups have their own unique sets of needs. Younger employees will likely value programs that offer opportunity for student loan debt consolidation, while those who have recently started families may favor programs that include health and life insurance policies. Others may be more attracted to programs with retirement benefits.

While age and life stage are important factors in financial wellness, it is important to assess other demographical contributors as well. MetLife recommends the administration of surveys, focus groups, or observational methods to effectively gauge employee needs, knowledge, and financial competency in order to determine the appropriate level of intervention. The most successful financial wellness programs equally consider and tend to the current and future needs of all employees.

In addition to being inclusive, financial wellness programs should be informative and offer flexibility in how information is obtained. It is imperative that employees have a clear understanding of what it means to be financially well and how to effectively utilize the services and tools available to them. Seminars, webinars, and counselling are a few ways to deliver this vital information. Providing various means of communication is an effective way of ensuring that material is delivered on the broadest scale possible, which will maximize the success of the program.

The final step of creating a successful, comprehensive financial wellness program is determining an effective means of obtaining the necessary financial resources. This may require the addition of a third-party. As phrased by Metlife, an ideal vendor partner is one that “can offer multi-channel capabilities that can support all aspects of financial wellness, especially the specific goals identified in the employee assessment.” Business leaders should choose a partner that best coordinates with the structure of their program and the needs of their employees.

Incorporating financial wellness benefits into an employee wellness program is a strategic intervention to improve company culture and broaden the impact of an existing wellness program. The program will help retain and attract quality employees and improve productivity by alleviating stress in the workplace.