Over the last century, Americans’ spending on non-essential consumer goods and services has grown substantially, as needs like food and shelter no longer require the large majority of a family’s income. Additionally, the increased availability of credit cards has further fueled excessive spending habits, and the prevalence of storage units makes limited space at home less of a concern. Despite the old adage that “money can’t buy happiness,” buying new material items does seem to bring many people a temporary rush of joy, leading to shopping addictions and wasteful behaviors. Ultimately, this doesn’t create any lasting feelings of satisfaction or fulfillment—but this doesn’t mean that more wealth can’t foster sustained happiness at all. Plus, earning more money can be a great motivator for employees and encourage better focus and performance.

A Popular Science article delves into the many ways that spending money optimally can increase happiness. While most material possessions don’t typically provide long-term joy, wealth can be invested in the things that do support long-term happiness and wellness—namely, life experiences and social connections.

One effective strategy is to look for ways to “buy time.” Time constraints add to stress levels and prevent people from exercising, eating more healthfully, spending time with friends, and enjoying the hobbies they love. Outsourcing errands, hiring a home cleaning service, investing in an afternoon of childcare, or even paying more for a direct flight can open up space in schedules and allow people to feel less stressed and more in control of their lives. Of course, this is most effective if people use that extra time on activities that support their well-being, such as socializing, spending time with family, working out, or practicing a favorite hobby.

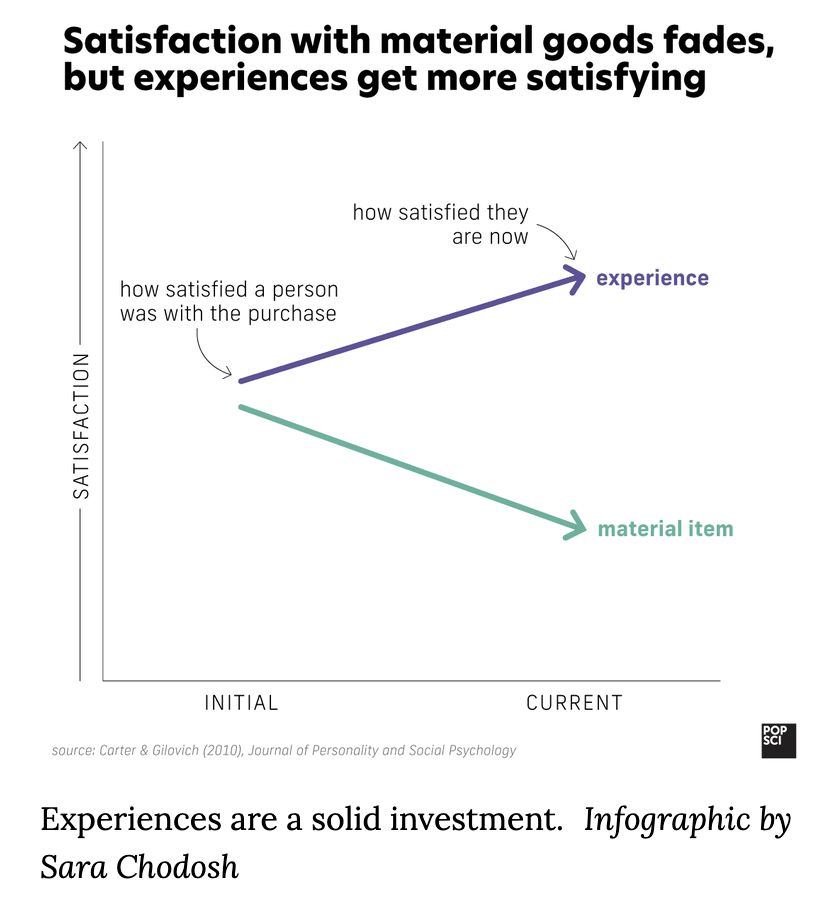

Research also links buying “experiences”—such as recreational activities, counseling, or vacations—as creating more happiness than purchasing material items. Experiences create cherished memories and stronger relationships with family and friends that can boost emotional wellness long after the actual experience has ended. It’s important to note that, sometimes, material items are a part of that “experience” investment; buying art supplies to begin a new hobby, for example, requires a material purchase. However, the purpose behind this spending goes beyond accumulating more stuff and will be more fulfilling.

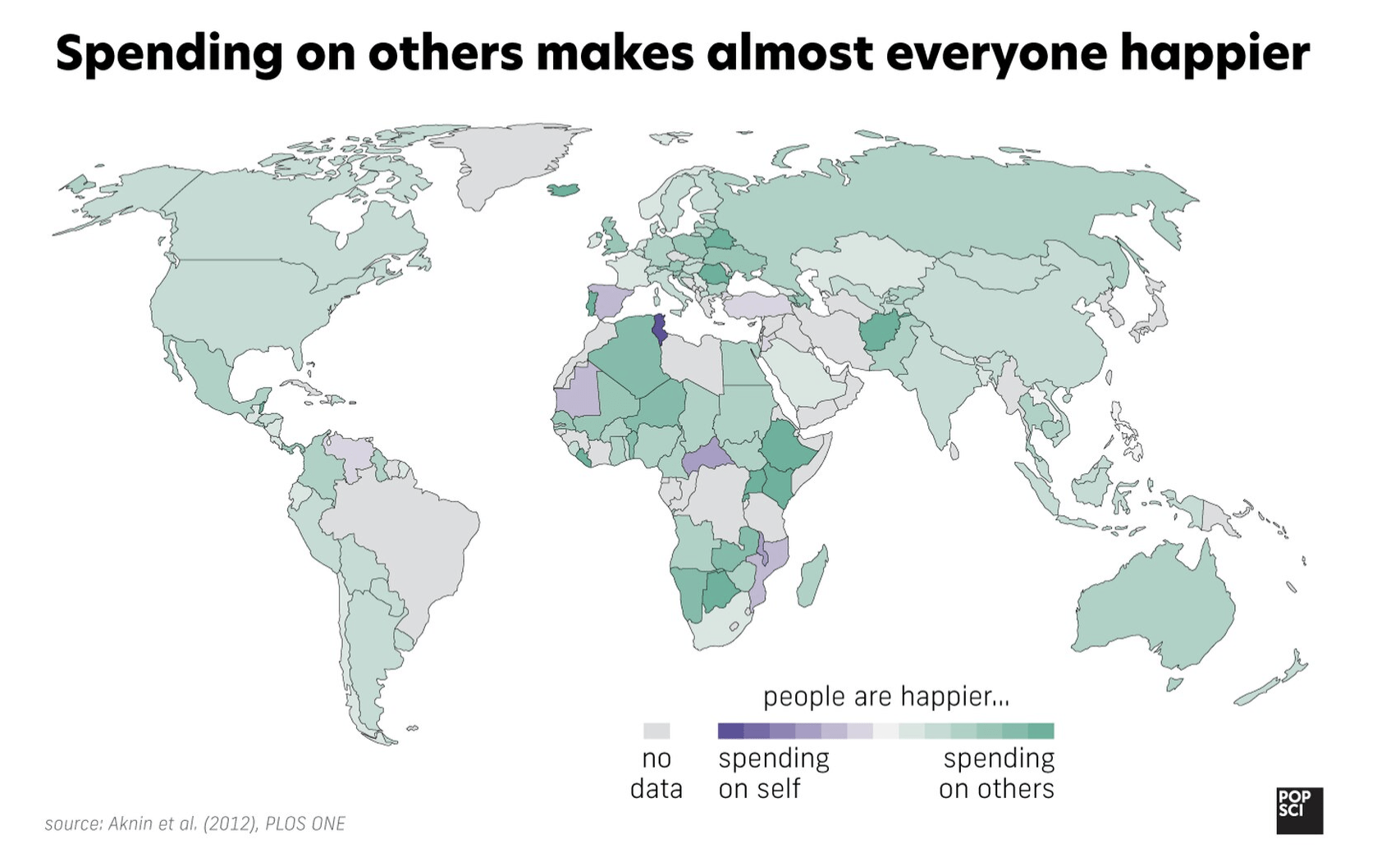

Spending on others is also directly tied to well-being, including a decreased risk of morbidity and mortality among adults and even lower blood pressure. Generosity even activates areas of the brain associated with social attachment and pleasure. Additionally, supporting a charity or cause that is personally meaningful to someone can boost feelings of happiness, and can even create a greater sense of purpose.

Financial Wellness Contributes To Overall Well-being

When employees feel good about their monetary decisions and comfortable with their financial situation, their mental and emotional well-being improves, leading to happier and more productive employees. Individuals addicted to shopping or dependent on material items to boost their mood may struggle with stress, feelings of inadequacy, or a lack of control over personal budgets. In a comprehensive wellness program, financial health isn’t just about retirement contributions or a good salary; it needs to also address the employees’ relationship with money, budget management, and the daily spending habits that can influence their mood.

Companies can help workers enhance the relationship they have with their finances by providing content that explains how spending a certain way can improve their mood and well-being. Other wellness benefits, such as generous paid time off for vacations, family activities, and volunteer work or matching employees’ charitable donations, can also enable more of these attitude-boosting financial habits.