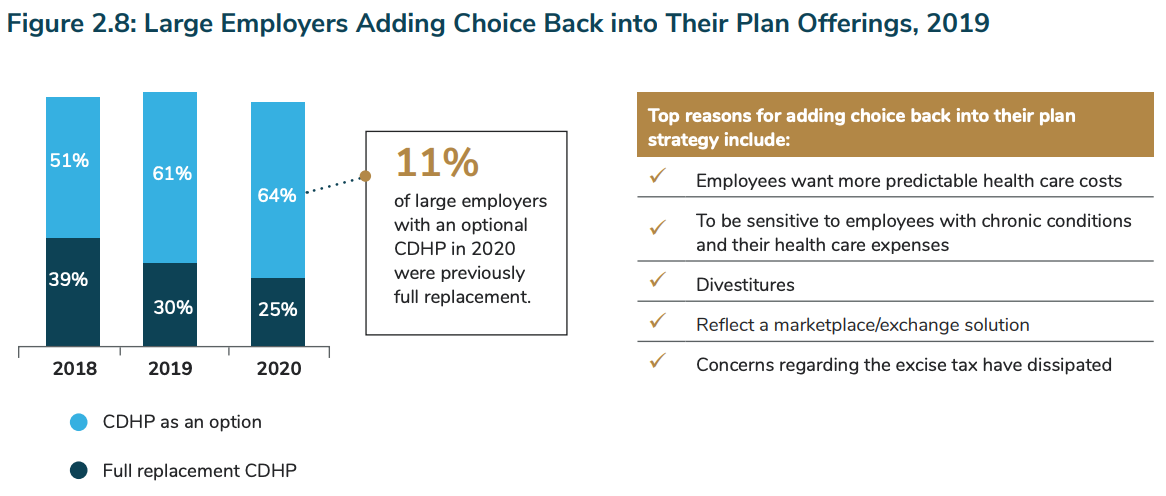

For the second year in a row, fewer large employers are offering high-deductible health plans (HDHP) as the only option for employees. National Business Group on Health’s Health Care Strategy and Plan Design Survey found that in 2020, 25% of large employers will offer only a high-deductible health plan with a health savings account. This change is down from 39% in 2018.

Multiple Reasons For Decline

HDHPs came to the forefront as health care expenses increased and employers looked for ways to share medical costs and responsibility with employees. The idea was that as employees paid for a more significant proportion of healthcare needs, they would become more informed and conscious of cost savings. They would ask if specific medical procedures were necessary or if generic medicines were available.

Unfortunately, that degree of consumerism never occurred, National Business Group’s Chief Strategy Officer Ellen Kelsay said in a press conference on the survey findings. “Health care is just, quite honestly, too complex for employees to navigate. So despite the best efforts to engage employees through those plans and engage them in more consumer-type behavior, that hasn’t necessarily resulted.” In actuality, for example, some employees are under insured because they are more concerned more about health care costs than being at the right level of health coverage.

Although enrollment in HDHPs is still high at 46%, employees have indicated to their employers that they want more predictable health care costs and additional choices for chronic conditions and for taking care of health care expenses, the survey said. Employers are listening, as they understand that offering relevant benefits plays a considerable role in attracting and retaining employees. In the study, 36% of companies said their health care strategy was an integral part of their workforce strategy, an increase of 9% from 2019.

Perhaps another reason for the decline is because many of these HDHPs were implemented in response to an impending Cadillac tax for expensive insurance plans. However, that tax, which was initially scheduled to go into effect in 2018, has been delayed several times and now is slated to take effect 2022. The delays and uncertainty of whether the tax will take place have led companies to look at additional options to HDHPs.

Companies Consider Several Options to HDHPs

Large companies are looking at other cost containment options, the survey said. Forty-nine percent of companies said they will implement advanced primary care strategies in 2020, with more companies considering it for 2021/2022. These emerging trends include:

- 24%: Steerage to physician-based accountable care organization (ACO) or health professions network (HPN)

- 34%: Primary care at on-site/near-site health centers

- 20%: Virtual primary care services (beyond traditional telehealth)

Reducing costs and improving patient care means more reliance on primary care physicians (PCPs). As the initial point of contact, a PCP can be less expensive than seeking a specialist. Additionally, the PCP becomes the gatekeeper, managing treatment, authorizing referrals to specialists, and being the main point of contact to provide a whole-person treatment.

Even as the healthcare landscape continues to evolve, one thing is certain. Whether an organization has an HDHP, an ACO, or another type of health coverage, wellness programs augment any healthcare coverage and provide employees with tangible ways to improve their well-being.