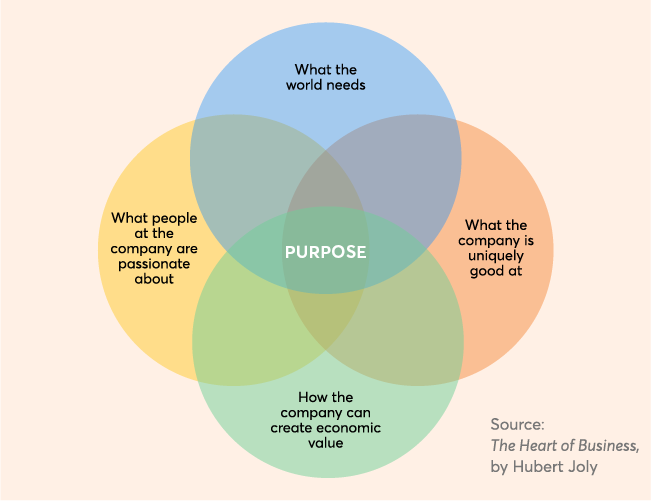

Becoming a homeowner is one of the biggest financial decisions that an individual can make in their life. Because of this, the process of purchasing a home can be stressful, overwhelming, and costly. However, homeownership can bring with it several significant wellness rewards, which can lead to happier, healthier, and more productive employees.

Organizations looking to supplement their typical array of benefits with something a little more novel but just as impactful should consider offering homeownership benefits (HOBs) designed to make the process of purchasing a home easier and less financially burdensome. To help companies determine if this benefit makes sense for them, below are some of the main ways in which homeownership can have wellness-enhancing effects, the positive organizational effects of HOBs, and a variety of types of HOBs which provide assistance at various points in the homebuying process.

Homeownership + Well-Being

For many individuals, homeownership can have a substantial impact on multiple dimensions of wellness. Most obviously, owning a house can improve an individual’s financial wellness. Though owning a home comes with its own set of financial risks, it has several advantages over renting (e.g., monthly rates for mortgages are generally cheaper than rental rates, homeowners can sell their homes to recoup costs, and homes can act as a hedge against inflation).

Homeownership may also have a significant influence on one’s environmental wellness, which refers to the degree to which the various environments one inhabits (e.g., their home, car, office, etc.) are conducive to their, health, happiness, goals, and values. Renters are typically severely limited in terms of the amount of control that they have over the look and feel of their units, as landlords often prohibit even small renovations. Homeowners on the other hand, can design their homes to their hearts content (though homeowners associations can still restrict some of their decisions). Ultimately, this puts homeowners in a better position to craft their living spaces in ways that inspire happiness and productivity.

Homeownership Benefits

Homeownership benefits aren’t just good for employees, they are good for their employers as well. This is because the effects of homeownership itself along with the knowledge that one’s employer has made it easier and less financially burdensome to accomplish one of their most significant goals, are likely to result in positive changes to several organizationally relevant outcomes, including:

- Recruitment and retention: At a time when younger generations are actively looking for more fulfilling, wellness supporting jobs and are struggling to come up with funds to purchase their first homes, offering HOBs can check a number of boxes. As a result, younger workers may be more likely to pick and stick with a job that offers unique and desirable benefits like HOBs.

- Productivity and engagement: Since homeownership can be good for wellness, which often leads to increased productivity and engagement, increasing the number of homeowners within an organization is likely to result in a more productive and engaged workforce. Moreover, the knowledge that one’s employer has gone through the trouble of designing an implement HOBs can spark a desire to work harder and more thoughtfully.

Aside from these changes in employee sentiment and efficiency, HOBs may put employers in a better position to incentivize their workers to live nearby their offices. With many employees hoping to continue to work remotely and live wherever they desire, companies are looking for ways to encourage them to come back to the office. By selectively providing HOBs to employees who are willing to live in locations that make daily commutes possible, organizations stand to persuade employees to return to the office who might otherwise have been reluctant to do so.

Types Of Homeownership Benefits

Financial Incentives

From realtors to home inspections to down payments to closing costs, the path to homeownership involves several (sometimes unexpected) costs. One of the main ways that organizations can make home ownership easier for employees is by making these payments less expensive. To accomplish this, organizations should consider providing yearly stipends for housing costs or helping employees access government sponsored grants designed to help first-time buyers.

Access To Information And Experts

Even with sufficient funds, becoming a homeowner can be a confusing, stress-inducing process. For some, a lack of confidence in their ability to make their way through the homebuying process without making financial mistakes can discourage them from achieving their property-owning goals. To combat this, organizations can provide their employees with relevant homebuying information and access to experts that can answer their questions and guide them towards smart choices. For instance, organizations can offer:

- Seminars: An in-house home-buying seminar is a great way for employees to learn about several components of the homebuying process (e.g., mortgages, how to save for a down payment, common unexpected costs, etc.).

- Credit Counseling: Credit counseling can help employees learn about the impact of credit scores on mortgages and other housing-related loans, how to check their credit scores, and how to improve them if they are too low. Consider partnering with a respected credit counseling firm or allowing employees time off to attend a credit counseling course outside of the workplace.

- Real Estate Professionals: Finding the right house often requires the input of an expert. However, finding and paying for the right expert can be a strenuous process all on its own. By providing employees with a real-estate professional or directing them towards a set of vetted experts employers can make the home searching process quick and easy.