Financial wellness refers to one’s financial stability and overall ability to manage their economic life. For many years, organizations have utilized only a small range of offerings to improve their employees’ financial health. As financial wellness benefits expand and the call for a broader range of solutions intensifies, businesses are beginning to adjust their offerings.

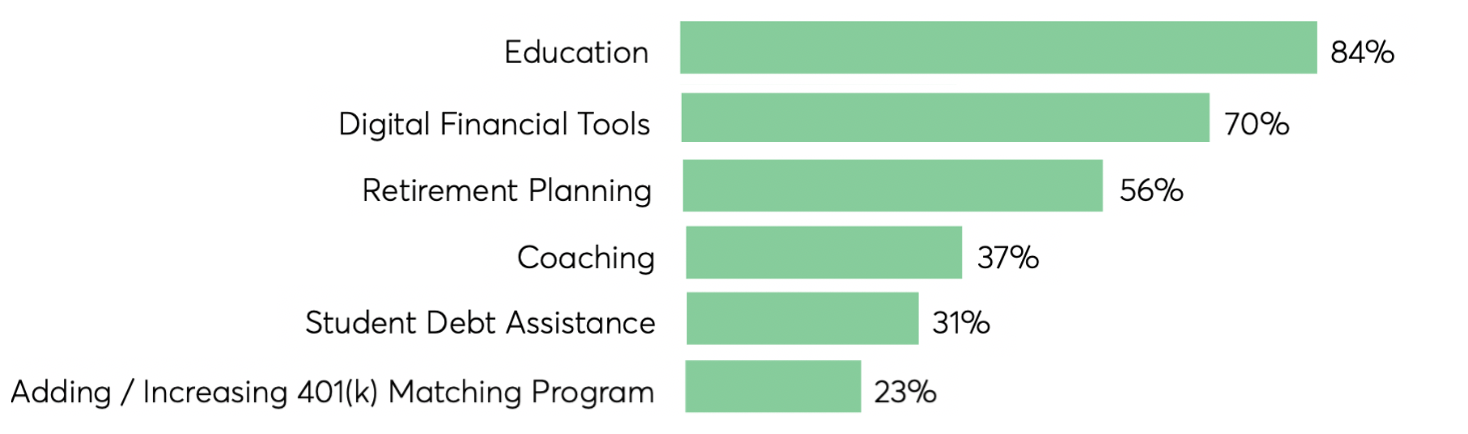

The Employee Wellness Industry Trends Report asked brokers to pick the top three new solutions their clients are using to promote financial well-being in the workplace.

What new offerings are your clients using to promote financial wellness in the workplace (choose top 3)?

From the data, clear patterns emerged, foreshadowing the future of financial wellness benefits. While education remains a popular new offering, employers are reluctant to add on or upgrade other traditional benefits. Most notably, adding or increasing 401(k) matching programs was listed as a top new offering by just 23% of brokers, though this may be the result of matching programs already being in place at many employers. Conversely, digital finance tools are highly sought after, listed as a top new benefit by 70% of brokers.

Wellable Labs spoke with financial well-being expert, Peter Dunn (a.k.a., Pete The Planner), to explore digital finance trends and examine the future of financial wellness benefits.

What are digital finance tools?

It’s funny because different aspects of the financial world all sort of claim digital finance tools. As it relates to personal or financial well-being, I would say it’s a series of assessments, tools, and calculators that can take a person on a self-contained journey to get the information or outcomes they want.

Why are employers moving away from more traditional financial wellness benefits and towards digital finance tools?

I think this idea of choosing your own adventure is something that consumers have been obsessed with since late elementary school, when they started reading choose your own adventure books. I think that’s what’s appealing about social media and digital tools outside of finances.

With traditional financial wellness, if we’re talking about retirement planning with a 401(k) account, it seems like it’s someone else’s priority, not yours. I think the digital tools do a better job of making the person feel like they’re in control of what’s happening.

Do you think that some of the more traditional solutions, such as 401(k) contributions and retirement planning, still have value or are necessary components of a complete financial wellness package?

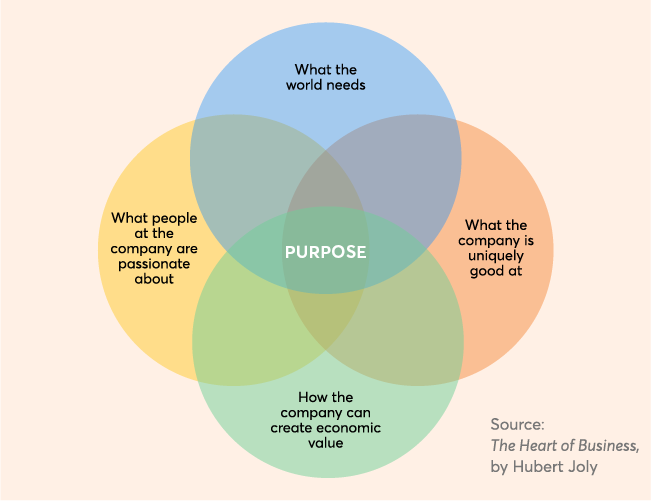

I don’t think it’s a matter of leaving certain benefits behind because I tend to think that most exist for a reason, and they do serve a particular portion of the population. So no, I don’t think they should be abandoned. Companies still need a 401(k) and some mechanism to help people with retirement planning.

I will say that general education, wherein someone is able to say, “Oh, I know what a mutual fund is now,” in my opinion, doesn’t really serve anyone. Unless it leads to action or behavior change, it’s just, “Hey, I know some neat stuff.” It’s a bunch of content that doesn’t intersect with reality, and I say that having built several education platforms that don’t intersect with reality.

Why are other new benefits, like student debt assistance, struggling to gain traction?

A few different ideas. One is timelier…there wasn’t necessarily the need for student loan relief within the last two years because the government provided it. People haven’t made a payment in what will be twenty-seven months. That’s a pretty good student loan program.

I think the second thing is, and this is very anecdotal, that decision-makers within an organization might view someone’s student loans and their past decisions as problems that have nothing to do with them. So, I think there’s just a general reluctance around student loan forgiveness culturally.

To give people in their twenties a pass here, housing is more expensive than it was thirty years ago. So is healthcare, childcare, and several other things. So, it’s not as simple as, “Hey, we’re going to take care of student loans,” because all these other areas are so problematic.

What do you think the future of financial wellness benefits looks like?

I think it’s just going to go the more digital route. For years, financial wellness vendors have been comparing themselves to an Apple Watch or to a Fitbit and all of their components. I don’t know if that perfect solution exists yet, though.

I think you’re going to see more behavioral economics come into financial wellness to account for people’s human nature. We all have vices, and if there’s a particular vice you’re trying to control, one of the smartest things you can do is to try to figure out when you’ve put yourself in a circumstance in which you may indulge in that vice. From a discretionary spending standpoint, what behavioral economics, to some degree, would do is prep people for those urges to go spend when they shouldn’t. That’s the idea, at least.

I think that at some point, AI comes into this, and then it turns into, “Okay, we’ve asked you a bunch of quantitative and qualitative questions and we’re going to combine all this data to create this persona that is predictive in nature.” So, I think that’s in the wheelhouse. I know a lot of are people working on it.