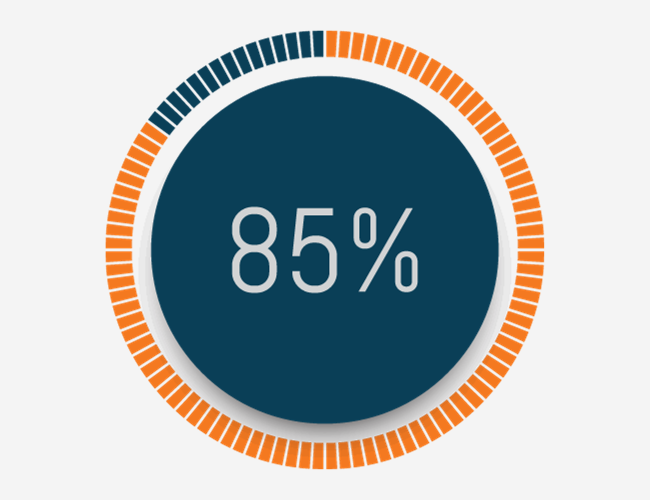

High-deductible health plans (HDHPs), which shift more of the upfront financial burden of healthcare expenses onto members, operate on the assumption that the financial risk associated with the plans will make members their own best care managers. Also, these plans typically offer the greatest savings and are the lowest-cost option for employees in terms of their paycheck deduction, making them an attractive option. As a result of this thinking, HDHPs have grown significantly over the years with 53% of employers offering them as an option (up from 39% in 2015), according to Healthcare Trends Institute’s fourth annual Benefits Benchmark Survey.

The survey also identified how employers are bracing for increasing costs and rounding out the top three were efforts to increase employee health care engagement (22%) and wellness and health management programs (18%). In laymen terms, employers should help employees become more knowledgeable consumers of healthcare and engage in healthy behaviors to prevent costly healthcare encounters.

In regard to health literacy, employers need to provide members with the resources and tools to understand how healthcare works and how to make better purchasing decisions when it comes to consuming healthcare. This goes beyond providing resources and materials that employees will never look at. One option would be to offer a gamified approach to health literacy with tools like Quizzify. Engaging employees in health literacy is different than simply offering resources, and employers need to be more proactive in addressing gaps in literacy, especially as they see their employees flock to lower-premium HDHPs.

The same can be said about wellness programs (i.e., employers need to be proactive and innovative). Since HDHPs are often associated with Health Savings Accounts (HSAs), providing wellness programs linked to contributions to HSA accounts can encourage employees to engage in healthier lifestyle while creating financial reserves that can offset their high deductibles. Since many employers already contribute funds to HSA accounts on behalf of employees, the budgetary impact to linking these contributions to wellness engagement can be minimal. Wellable is currently running similar programs with employers, and their employees are benefiting from these programs in multiple ways.

If the growth of HDHPs continues, employers offering innovative ways to assist employees with the transition will benefit from a happier and more financially well workforce.