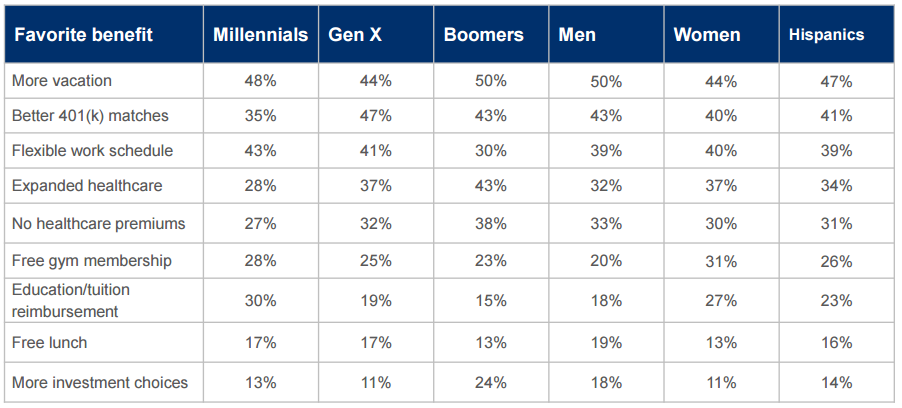

New research from MassMutual found that preferences for healthcare insurance, retirement savings, vacation, and other benefits for U.S. employees largely hinge upon workers’ generation and gender, complicating benefit choices for employers with diverse workforces. Overall, 47% of American workers age 18 and older prefer more vacation time, and 44% prefer better 401(k) matches. However, notable differences do exist amongst subgroups of respondents. The chart below shows the breakdown by generation, gender, and ethnicity for responses to: “Which three benefits would you most like to receive from your employer?”

Upon closer inspection, however, Baby Boomers (ages 50-70) and Millennials or Generation Y (ages 15-35) opt for more time off from work while Generation X (ages 36-49) favors richer retirement benefits. Men tend to prefer more time off while women focus more on health-related benefits, like free gym memberships.

Generational Preferences

After choosing more time off, Boomers expressed preferences for financial benefits. 43% of Boomers would like better 401(k) matches, 38% would appreciate having free healthcare coverage, and 24% wanted more investment choices for their retirement savings. Four in 10 (43%) want expanded healthcare benefits. Breaking with Boomers, Millennials like the idea of flexible work schedules (43%) and reimbursements for education and tuition (30%). But many Xers joined their Boomer colleagues in wanting better 401(k) matches, most likely a reflection that few Xers have access to pensions and that many Boomers having not saved enough for retirement.

Gender Preferences

Men’s benefits of choice were more vacation time (50%), better 401(k) matches (43%) and flexible work schedules (39%). Women’s preferences were more evenly spread between more vacation (44%), better 401(k) matches and flexible work schedules (40%), expanded healthcare premiums (37%) and free gym memberships (31%). In addition, there were bigger disparities between men and women when it came to benefits such as free gym memberships (men: 20%; women: 31%), education/tuition reimbursement (men: 18%, women: 27%), and more investment choices for retirement (men: 18%, women: 11%).

According to Elaine Sarsynski, Executive Vice President of MassMutual Retirement Services and Worksite Insurance, employers should address the varied preferences for employee benefits by “offer[ing] as broad a menu of benefits as possible and consider[ing] offering new or expanded benefits on a voluntary or employee-paid basis. There clearly isn’t a set of specific benefits that appeals to all U.S. workers or even a subgroup of workers (the most popular categories topped off at 50%). This further emphasizes the need for diverse benefits even for non-diverse groups.